FEATURES OF TRASTRA

Let’s take a look at what you can do with TRASTRA:

PAYMENT CARD

You can link your TRASTRA Visa debit card to a multi-crypto wallet, and pay for goods in Euro. There’s no need to visit a bank; the card is delivered directly to your home. Use the card to withdraw money at ATMs, manage your funds while out and about, and spend currency anywhere. Use the TRASTRA banking app to receive push notifications, load your card instantly, and disable the card if you ever lose it. The TRASTRA crypto card is also compatible with contactless payments – you can use your smart watch or your smartphone to complete cryptocurrency payments. Alternatively, you can complete one-touch payments with the card by using its integrated PayPass technology. Each transaction made with the TRASTRA crypto card is reviewed and approved via the Verified by Visa check. When making online transactions, it must pass VISA 3D security protocol. And, lastly, all TRASTRA cryptocurrency cards use chip technology for an additional layer of security.

LIMITS OF TRASTRA CRYPTOCURRENCY CARD

After a review of the card’s limits, we found that you can spend up to 8,000 Euro per day. This was recently increased per request from customers. You can also have a maximum balance of 8,000 Euro. Card users may withdraw up to 300 Euro on an ATM per day.

TRASTRA CRYPTOCURRENCY CARD FEES

There is no card load fee, as well as no Euro offline or online purchase fees. For non-Euro purchases, card users will need to pay a fee of 3% of the transaction’s value. For card-to-card internal transfers, there’s a 0.20 Euro fee. ATM balance inquiries are 0.35 Euro each, and ATM PIN changes are 0.40 Euro. For each ATM withdrawal, TRASTRA charges a 2.25 Euro fee. For an ATM foreign exchange withdrawal, there is an additional 3% added to the 2.25 Euro. And, lastly, there is a monthly management fee of 1.25 Euro. The first charge will occur after the first time you’ve loaded the card.

Function |

Fees |

|---|---|

| Card order | 9.00 EUR |

| Card load | Free |

| Euro Offline purchase | Free |

| Euro Online purchase | Free |

| non-Euro purchase | 3% of the transaction’s value |

| Card-to-card internal transfers | 0.20 EUR |

| ATM Balance Inquiry | 0.35 EUR |

| ATM PIN changes | 0.40 EUR |

| ATM withdrawal | 2.25 EUR |

| ATM Transaction with Foreign Exchange | 3% +2.25 EUR |

| Monthly card management | 1.25 EUR |

CORPORATE CARD OPTIONS

If your online business generates cryptocurrency revenue, you can use TRASTRA’s business services for your checkout process and to pay your employees.

CREATE CRYPTO WALLETS

You can use TRASTRA to store 7 of the world’s most popular cryptocurrencies, in addition to exchanging them for fiat currency. With TRASTRA’s crypto wallets, you can store, send, receive, exchange, and withdraw cryptocurrency – Bitcoin, Ethereum, Litecoin, BitcoinCash, Ripple, USD Coin and Tether to be exact. Use your crypto wallet’s transactional options to control the speed and the costs of your exchanges. You can pick a smaller mining fee and no commission, but it will come at a slower speed. If you want a medium speed, choose a moderate transaction fee. Even the highest transaction speed is available at a reasonable price.

TRASTRA MOBILE APP

Download the TRASTRA mobile app to manage your crypto wallet on the go. It is available for download on the App Store and on Google Play. You can use the app to create multiple crypto wallets, use its integrated QR code scanner in order to send crypto, and choose your mining fee (and subsequent transaction speed). You can also use the app to make POS (and ePOS) purchases, cash out crypto at an ATM, exchange crypto for fiat currency, and send, store, and receive cryptocurrency. Lastly, check out the TRASTRA app to search for transactions easily by using filters. Keep track of all inbound and outbound transactions, and receive push-notifications for account activity.

EASY

- Download the TRASTRA App and pass the KYC process

- Deposit crypto to TRASTRA wallet

- Convert crypto to Euro instantly

- Cash out EUR in ATM or spend in stores

- Receive fiat currency into your wallet with your personal integrated IBAN

SECURE

- Anti-fraud VISA 3D secure protection

- 2-Factor Authentication(2FA) one-time passcode

- New device or browser authorisation via email

- Anti-skimming protection technology

- VISA identity check protection

- Strong jurisdiction and regulation

CONFIDENTIAL

- No bank account needed

WHO IS TRASTRA FOR?

While anybody can benefit from TRASTRA’s services, after a review of what it can do, we believe that gamblers, forex traders, freelancers, cryptocurrency miners, and online businesses stand the most to gain from the service’s benefits. The anonymity of TRASTRA makes it ideal for transactions that a normal bank would not allow.

List of 31 countries where you can order the TRASTRA Individual Crypto Card©. The full current list of 31 EEA countries for TRASTRA card delivery is the following:

31 EEA countries |

31 EEA countries |

|---|---|

| Austria | Belgium |

| Bulgaria | Czech Republic |

| Croatia | Cyprus |

| Denmark | Estonia |

| Finland | France |

| Germany | Greece |

| Hungary | Iceland |

| Ireland | Italy |

| Latvia | Liechtenstein |

| Lithuania | Luxembourg |

| Malta | Netherlands |

| Norway | Poland |

| Portugal | Romania |

| Slovakia | Slovenia |

| Spain | Sweden |

| United Kingdom |

TRASTRA cards are also issued and delivered to the French-administered territories outside Europe:

French-administered territories |

French-administered territories |

|---|---|

| Guadeloupe | French Guiana |

| Martiniquea | Reunion |

| Saint Martin |

TRASTRA APP FAQS

TRASTRA lets you use QR codes to instantly add funds to your crypto wallets. To do so, follow these steps:

- Open your device’s camera.

- Point the camera at the QR code.

- Check the top of the screen for a notification.

- Tap on the notification; this will trigger the code’s action.

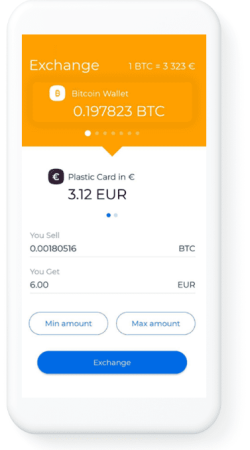

This is a fairly simple process. The steps are:

- Use the main menu’s slider to pick the crypto wallet you want to work with.

- Tap the dashboard’s Exchange icon.

- Input the amount of cryptocurrency that you would like to exchange.

- Tap on the Exchange button.

- Upon confirmation, your new funds will be sent to your Trastra card.

One great thing about the mobile app is that it lets you quickly and easily track purchases and other account activities. When you log in to your account, you can see your complete history of activity on the final balance page. To see further details about an activity, tap on it, and scroll down.

One security measure used in the Trastra crypto app is 2-Factor Authentication. Another one is 3D Secure – this means that you’ll need to enter your card’s CVC card, expiration date, and your date of birth before completing transactions.

Trastra accepts only residents of the countries of the European Economic Area (EEA): Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom.