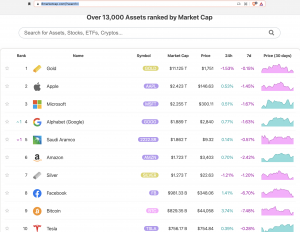

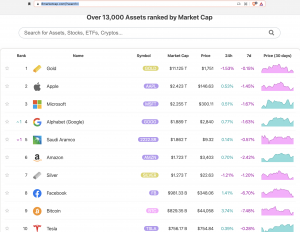

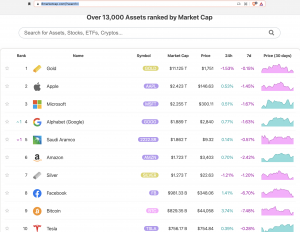

Interesting table showing assets ranked by market cap. Note that 4 of top 10 are digital service providers. Indicative of how the economy is transitioning from tangible hard assets to digital assets. Bitcoin in 9th place at time of writing is considered a store of value. That aligns it to it’s equivalent store of value I.e Silver and Gold. If Bitcoin is to meet Silver market cap which is two places above it on the table, the price of Bitcoin would have to increase above it’s all time highs in USD. If Bitcoin which is already considered digital Gold has same market cap as Gold; making it the reserve currency of the world, the required price per Bitcoin will be $500,000. As it grows to replace offshore deposits it’s price is likely to increase to $800,000 per Bitcoin. There are currently 18,823,887.5 Bitcoins in existence. The last Bitcoin is expected to be mined in 2040. Price per Bitcoin is expected to grow at an even greater trajectory when that 21 million Bitcoin supply is halted and yet demand continues. This can be facilitated by almost infinite divisibility and other units such as Bitcoin Bit. The other hidden factor endorsing Bitcoin price increase is that the US government is anticipating around $10 billion of tax revenue from Bitcoin profits realized. Where there is a US government vested interest in price increase; protectionist policies and actions exist e.g the stock market plunge squad has been deployed to keep the stock markets making new highs to keep up with inflation. So guess which direction they want Bitcoin price to go!?